Your Property Tax Bill Explained

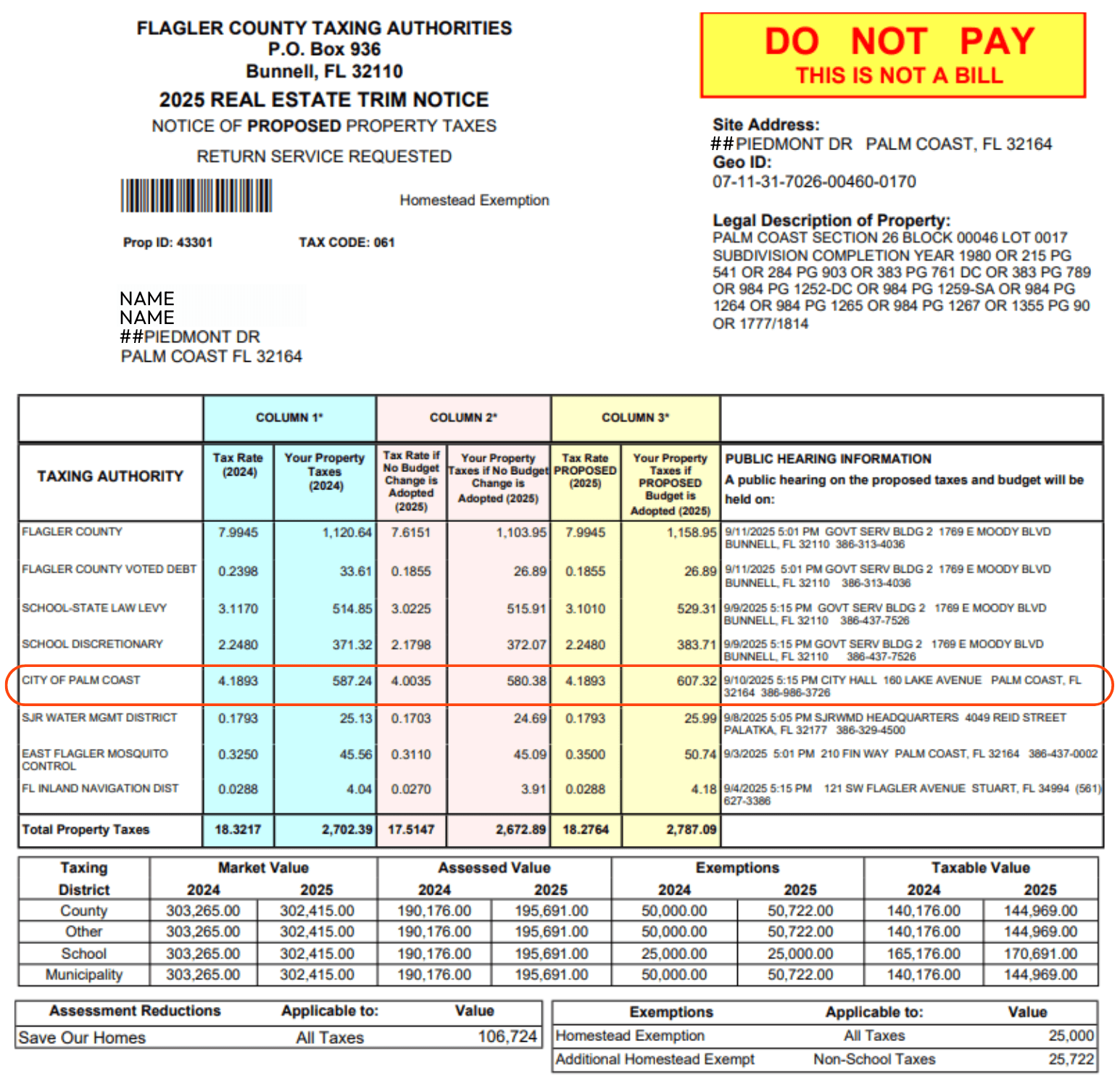

If you own property in Palm Coast, you pay property taxes. Your property tax bill is based on the assessed value of your property, any exemptions for which you qualify, and a property tax rate.. This page will break down those costs and help you plan your tax budget, avoid surprises, and spot costly errors.

Navigation Menu

To provide transparency, the City of Palm Coast offers an address search tool on our website, allowing you to see exactly how your tax dollars are allocated to various services and departments.

How is my property appraised?